What the tips against inflation

Posted by: admin 2 months, 4 weeks ago

(Comments)

Hedging against inflation involves taking financial or investment actions designed to protect the purchasing power of money in the face of rising prices. Inflation erodes the value of currency over time, so investors seek assets or strategies that tend to increase in value or generate returns that outpace inflation. Below are several ways to hedge against inflation:

### 1. **Invest in Inflation-Protected Securities**

One of the most direct ways to hedge against inflation is by investing in assets specifically designed to keep pace with rising prices.

- **Treasury Inflation-Protected Securities (TIPS)**:

- TIPS are government bonds issued by the U.S. Treasury that are indexed to inflation. The principal value of TIPS increases with inflation (as measured by the Consumer Price Index, CPI), ensuring that both the face value and interest payments adjust for inflation.

- **How it works**: If inflation rises, the bond’s principal increases, and the interest payments (which are a percentage of the principal) rise accordingly.

- **Why it works**: TIPS offer a guaranteed inflation hedge because their returns are tied directly to the inflation rate.

- **Inflation-Linked Bonds (ILBs)**: Other countries also issue inflation-linked bonds similar to TIPS. For example, the U.K. issues **Index-Linked Gilts**, and other nations have their versions of inflation-protected government securities.

### 2. **Invest in Real Assets (Tangible Assets)**

Real assets, or tangible assets, tend to hold their value or appreciate during periods of inflation because their intrinsic value is linked to physical utility or scarcity.

- **Real Estate**:

- Real estate values often rise with inflation. Rental income from properties tends to increase with general price levels, providing a natural hedge.

- **Why it works**: The price of land and property tends to rise in line with inflation due to increased demand and the scarcity of land as a resource.

- **Real Estate Investment Trusts (REITs)**: You can also invest in REITs, which pool investor funds to purchase and manage real estate properties. REITs provide dividends and often increase in value during inflationary periods as property values and rental income rise.

- **Commodities**:

- Commodities like oil, gold, and agricultural products often increase in price during inflationary periods because they are priced in real terms and tend to maintain their value as the purchasing power of currency declines.

- **Gold**: Historically, gold has been viewed as a safe-haven asset during times of inflation or currency devaluation.

- **Why it works**: Commodities are essential resources, and their prices often rise along with inflation, providing a buffer for investors.

### 3. **Invest in Stocks (Equities)**

Certain types of stocks can serve as an inflation hedge, especially those of companies that have pricing power or operate in industries that benefit from inflation.

- **Stocks of Companies with Pricing Power**:

- Companies that can pass on higher costs to consumers without losing significant sales (e.g., companies in essential sectors like energy, healthcare, or consumer staples) tend to perform well during inflation.

- **Why it works**: If a company can increase prices in line with inflation, its revenue and profits can keep pace with rising costs, making its stock a good inflation hedge.

- **Dividend-Paying Stocks**:

- Stocks that pay dividends can provide a steady income stream that may help offset the effects of inflation. Dividend growth stocks, in particular, are those where companies consistently increase dividend payouts, often in line with or above inflation rates.

- **Why it works**: Rising dividend payouts help investors maintain purchasing power over time, even if inflation erodes the value of fixed-income investments.

- **Commodities and Energy Stocks**:

- Companies in the **commodity** and **energy** sectors tend to benefit from rising prices for raw materials. When commodity prices (like oil, natural gas, and agricultural goods) rise, companies in these industries may experience increased profits, providing a hedge against inflation.

- **Why it works**: As commodity prices rise, the revenues and profitability of companies in this sector tend to increase, potentially leading to stock price appreciation and dividends.

### 4. **Invest in Hard Currencies or Foreign Exchange**

During periods of high inflation in one country, investors may hedge by holding foreign currencies or assets denominated in more stable currencies.

- **Foreign Currencies**: Investors can buy currencies from countries with low inflation rates and strong economic fundamentals. These currencies tend to hold their value better than currencies experiencing inflation.

- **Why it works**: A weakening domestic currency during inflationary periods leads to a relative appreciation of foreign currencies, providing a hedge against local inflation.

- **Foreign Currency Bonds**: Investing in bonds denominated in stable foreign currencies can also offer a return that is protected from domestic inflation.

### 5. **Commodities Futures and Derivatives**

- **Commodities Futures**:

- Investors can hedge against inflation by purchasing **futures contracts** on commodities like oil, gold, wheat, and other raw materials.

- **Why it works**: Futures contracts allow investors to lock in prices for commodities that are likely to rise during inflation, providing protection from inflation’s negative effects on purchasing power.

- **Inflation Swaps**:

- An inflation swap is a financial derivative used to transfer inflation risk between two parties. One party pays a fixed interest rate, while the other pays a variable rate tied to the inflation rate.

- **Why it works**: By using inflation swaps, investors can protect themselves from inflation by receiving payments that rise in line with inflation.

### 6. **Adjustable-Rate Debt**

- **How it Works**: During inflation, holding **adjustable-rate debt** (like adjustable-rate mortgages or bonds with floating interest rates) can help hedge against inflation because the interest payments adjust in line with inflation.

- **Why it works**: As inflation rises, interest rates tend to increase, so the payments on adjustable-rate debt rise accordingly, protecting the lender or bondholder from the effects of inflation.

### 7. **Short-Term Bonds or High-Yield Savings Accounts**

- **Short-Term Bonds**:

- During inflationary periods, short-term bonds are generally preferred over long-term bonds because inflation erodes the value of fixed payments. **Short-term bonds** mature quickly, allowing investors to reinvest at higher interest rates as inflation rises.

- **Why it works**: Short-term bonds limit the exposure to inflation because they are frequently rolled over, enabling the investor to adjust to higher interest rates as inflation increases.

- **High-Yield Savings Accounts**:

- High-yield savings accounts or **inflation-indexed savings accounts** provide interest rates that may adjust upward with inflation, offering a safer option for risk-averse investors seeking to preserve purchasing power.

### 8. **Cryptocurrency (Emerging and Riskier Hedge)**

- **Cryptocurrency** (like Bitcoin) is sometimes viewed as a potential inflation hedge, especially in periods of currency debasement or hyperinflation. Cryptocurrencies are decentralized and have limited supply (e.g., Bitcoin’s fixed supply of 21 million), which could theoretically protect against inflation.

- **Why it works**: In theory, as fiat currencies lose value due to inflation, the scarcity of cryptocurrencies might make them more valuable. However, this is highly speculative and volatile, and cryptocurrencies are not yet proven inflation hedges in the long term.

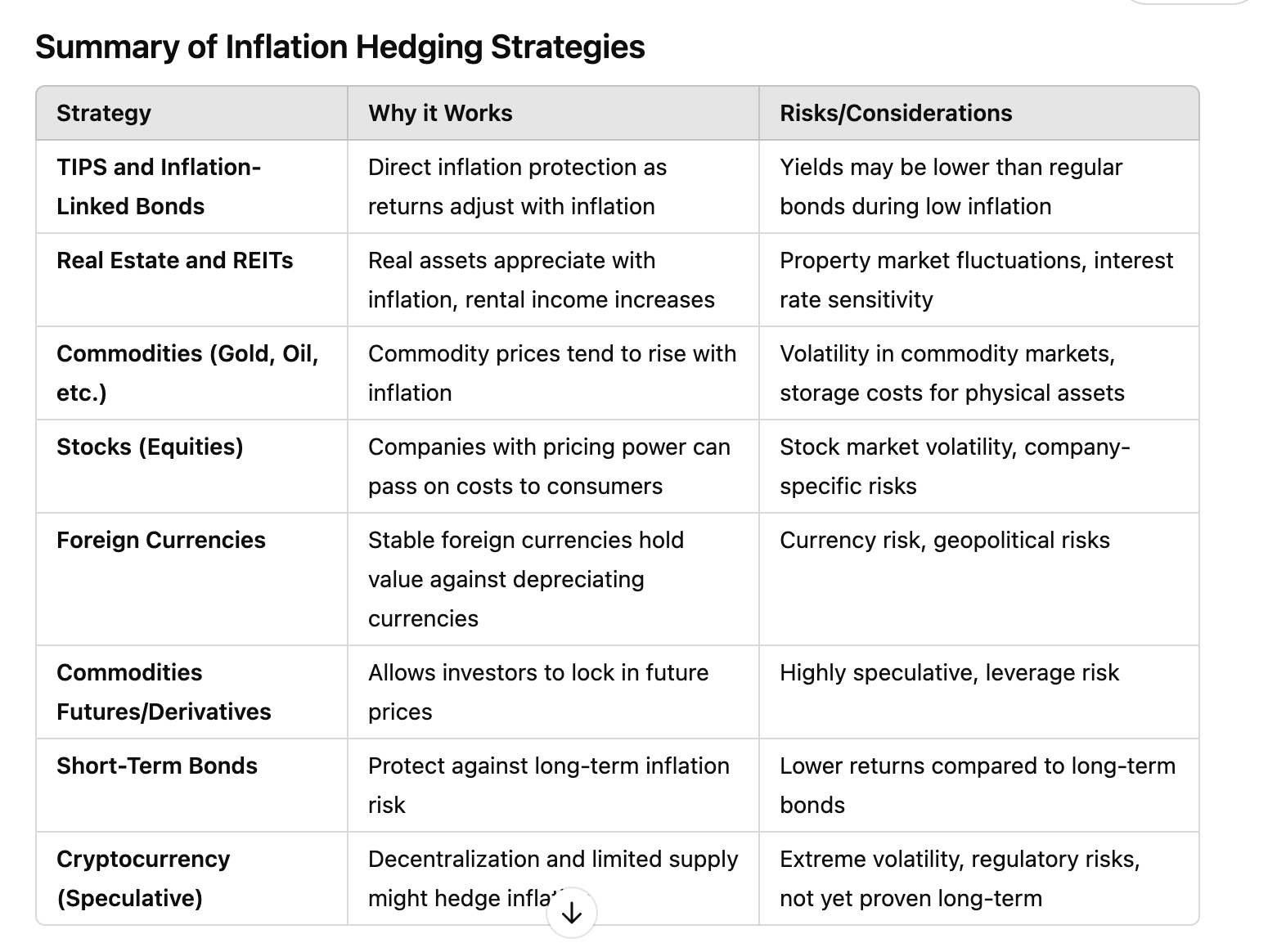

### Summary of Inflation Hedging Strategies

| **Strategy** | **Why it Works** | **Risks/Considerations** |

|------------------------------------|-----------------------------------------------------------------|--------------------------------------------------------------|

| **TIPS and Inflation-Linked Bonds**| Direct inflation protection as returns adjust with inflation | Yields may be lower than regular bonds during low inflation |

| **Real Estate and REITs** | Real assets appreciate with inflation, rental income increases | Property market fluctuations, interest rate sensitivity |

| **Commodities (Gold, Oil, etc.)** | Commodity prices tend to rise with inflation | Volatility in commodity markets, storage costs for physical assets|

| **Stocks (Equities)** | Companies with pricing power can pass on costs to consumers | Stock market volatility, company-specific risks |

| **Foreign Currencies** | Stable foreign currencies hold value against depreciating currencies | Currency risk, geopolitical risks |

| **Commodities Futures/Derivatives**| Allows investors to lock in future prices | Highly speculative, leverage risk |

| **Short-Term Bonds** | Protect against long-term inflation risk | Lower returns compared to long-term bonds |

| **Cryptocurrency (Speculative)** | Decentralization and limited supply might hedge inflation | Extreme volatility, regulatory risks, not yet proven long-term|

### Conclusion

To effectively hedge against inflation, it's important to diversify across assets that perform well in inflationary environments, such as **inflation-protected bonds**, **real assets**, **commodities**, and **stocks of companies with pricing power**. The best approach depends on your risk tolerance, investment horizon, and the specific economic environment you are facing.

Kenapa sekolah PhD butuh waktu lama!?

Recent newsKali ini kita akan bahas kenapa sekolah PhD itu lama! Tanpa panjang lebar, berikut cara ngeles gw! Maksudnya berikut alasannya! Hope its relate with you!

read more1 day, 2 hours ago

Using Vertex AI for zero one and two three AI prediction

Recent newsHere is my documentation after learning the introduction of AI in courserERA.

read more2 weeks, 4 days ago

Neural network with API for pre-trained API

Recent newsOverview

The Cloud Natural Language API lets you extract entities from text, perform sentiment and syntactic analysis, and classify text into categories.

read more2 weeks, 6 days ago

what is null result

Recent newsNull result in economic is when the output does not supporting your hypothesis

read more3 weeks, 1 day ago

3 weeks, 1 day ago

Fixing the issue in assumption of OLS step by step or one by one

Recent newsHi, I want to raise the issue related to know whether your OLS is ok or not.

read more1 month, 2 weeks ago

Meaning of 45 degree in economics chart

Recent newsThe **45-degree line** in economics and geometry refers to a line where the values on the x-axis and y-axis are equal at every point. It typically has a slope of 1, meaning that for every unit increase along the horizontal axis (x), there is an equal unit increase along the vertical axis (y). Here are a couple of contexts where the 45-degree line is significant:

read more2 months, 3 weeks ago

Collaboratively administrate empowered markets via plug-and-play networks. Dynamically procrastinate B2C users after installed base benefits. Dramatically visualize customer directed convergence without

Comments