What is the measurement of inflation

Posted by: admin 2 months, 4 weeks ago

(Comments)

Inflation is typically measured using price indices that track the changes in the price level of a basket of goods and services over time. There are several common methods and indices used to measure inflation, each tailored to different aspects of the economy. Below are the primary methods used for measuring inflation:

### 1. **Consumer Price Index (CPI)**

- **Definition**: The CPI measures the average change over time in the prices paid by consumers for a basket of goods and services.

- **How It Works**: National statistical agencies (like the U.S. Bureau of Labor Statistics) select a representative "basket" of goods and services that reflects what consumers typically purchase, such as food, housing, transportation, and healthcare.

- **Usage**: CPI is one of the most commonly used indicators of inflation, providing a good reflection of how inflation affects households. It’s also used to adjust wages, pensions, and government benefits to maintain purchasing power.

### 2. **Producer Price Index (PPI)**

- **Definition**: The PPI measures the average change in selling prices received by domestic producers for their output.

- **How It Works**: It tracks prices at the wholesale or production level, looking at the costs producers face for raw materials, intermediate goods, and finished products before they reach consumers.

- **Usage**: PPI is a useful early indicator of inflationary pressures, as increases in producer costs can eventually lead to higher consumer prices.

### 3. **Gross Domestic Product (GDP) Deflator**

- **Definition**: The GDP deflator measures the change in prices of all goods and services produced in an economy (i.e., the total output), reflecting the price level changes in an entire economy.

- **How It Works**: It’s the ratio of nominal GDP (GDP measured at current prices) to real GDP (GDP measured at constant prices), showing how much of GDP growth is due to inflation rather than an increase in real output.

- **Usage**: The GDP deflator provides a broad measure of inflation across an economy, as it includes prices for all goods and services, not just consumer-related ones.

### 4. **Core Inflation**

- **Definition**: Core inflation measures the long-term trend in prices by excluding certain volatile items like food and energy prices, which can fluctuate due to seasonal or short-term factors.

- **How It Works**: Core inflation is derived from the CPI but excludes categories like food and energy to give a better sense of underlying inflation trends.

- **Usage**: Central banks, like the Federal Reserve, often monitor core inflation to set monetary policy, as it provides a more stable indication of inflationary pressures.

### 5. **Personal Consumption Expenditures Price Index (PCE)**

- **Definition**: The PCE measures the change in prices of goods and services consumed by households and is broader than CPI.

- **How It Works**: It covers a wider range of goods and services than the CPI and accounts for changes in consumer behavior (such as substituting cheaper goods when prices rise).

- **Usage**: The PCE is the Federal Reserve's preferred measure of inflation because it better reflects consumer choices and adjusts for changes in the composition of spending.

### 6. **Wholesale Price Index (WPI)**

- **Definition**: The WPI measures the average change in prices of goods at the wholesale level, before they reach consumers.

- **How It Works**: It tracks the price changes of commodities traded in bulk (such as food, fuel, and raw materials).

- **Usage**: WPI is more commonly used in some countries (like India) to measure inflation at earlier stages of production and distribution.

### 7. **Trimmed Mean and Median CPI**

- **Definition**: These are alternative measures of inflation that reduce the impact of extreme price changes in certain categories.

- **How It Works**:

- **Trimmed Mean CPI**: This index excludes a fixed percentage of the highest and lowest price changes each month to smooth out volatile movements.

- **Median CPI**: This index looks at the price change of the item in the middle of the distribution (the median), ignoring extreme price increases or decreases.

- **Usage**: These measures give a more stable and less noisy picture of underlying inflation trends, which is helpful for policymakers trying to identify persistent inflationary pressures.

### 8. **Import and Export Price Indices**

- **Definition**: These indices measure the changes in the prices of imported and exported goods and services.

- **How It Works**: By tracking changes in the prices of internationally traded goods, these indices help measure the inflationary pressures that arise from global trade.

- **Usage**: They are particularly useful for countries heavily reliant on imports or exports, as changes in global prices can influence domestic inflation.

### 9. **Cost of Living Index (COLI)**

- **Definition**: A COLI measures the amount of money required to maintain a specific standard of living, factoring in price changes for goods and services.

- **How It Works**: It aims to reflect how inflation affects an individual's or household's overall ability to afford the same standard of living.

- **Usage**: While not as commonly used as CPI or PCE, COLI is helpful in understanding the broader impact of inflation on living standards.

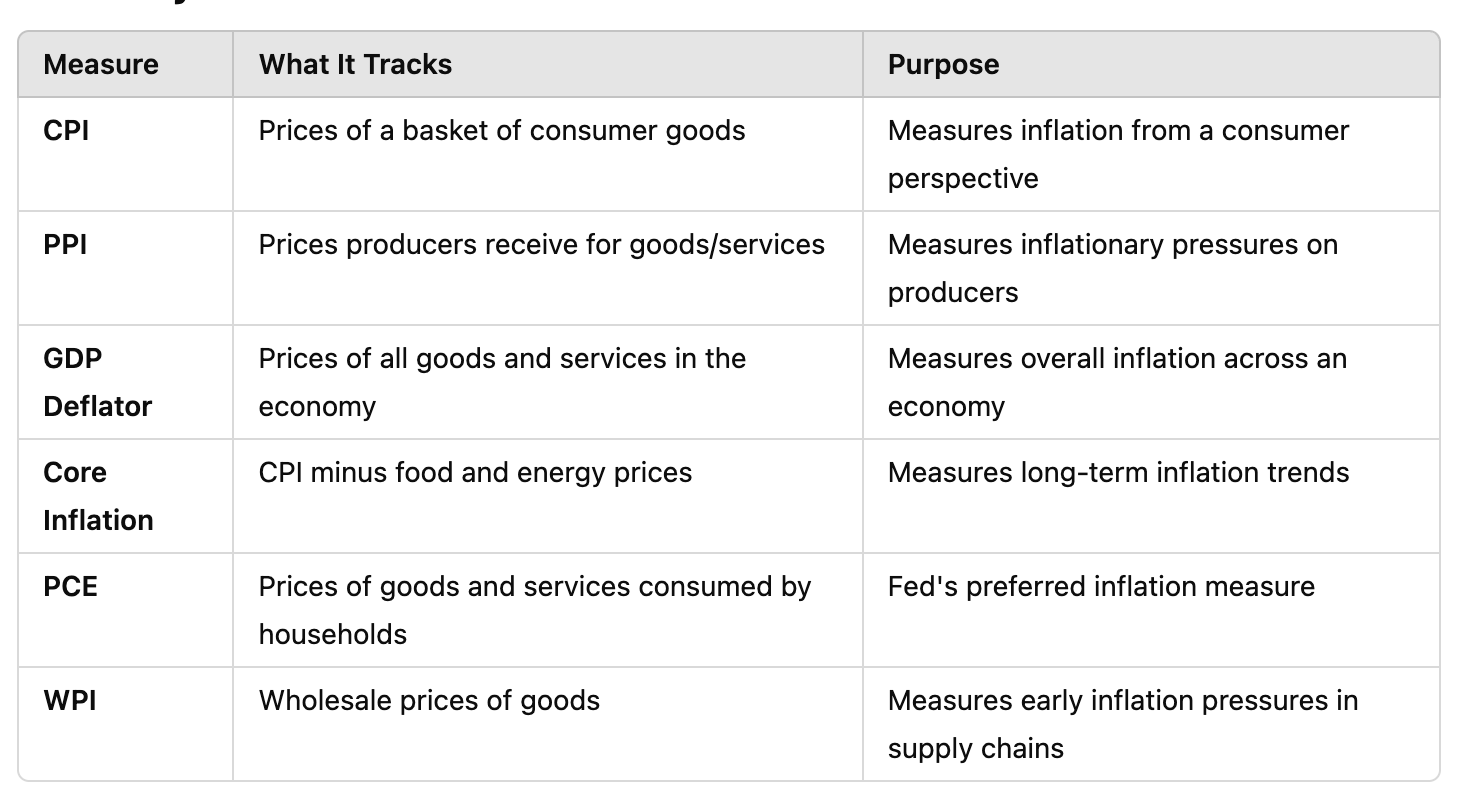

### Key Differences Between Measures:

- **CPI**: Focuses on the prices of a fixed basket of goods and services.

- **PPI**: Looks at price changes from the producer's perspective.

- **GDP Deflator**: Measures price changes across the entire economy, including consumer goods, investment goods, and government services.

- **Core Inflation**: Excludes volatile items to reflect underlying trends.

- **PCE**: Captures a broader range of consumption and adjusts for changes in consumer behavior.

Each measure serves different analytical purposes and provides different insights into how inflation affects various sectors of the economy.

Kenapa sekolah PhD butuh waktu lama!?

Recent newsKali ini kita akan bahas kenapa sekolah PhD itu lama! Tanpa panjang lebar, berikut cara ngeles gw! Maksudnya berikut alasannya! Hope its relate with you!

read more1 day, 7 hours ago

Using Vertex AI for zero one and two three AI prediction

Recent newsHere is my documentation after learning the introduction of AI in courserERA.

read more2 weeks, 4 days ago

Neural network with API for pre-trained API

Recent newsOverview

The Cloud Natural Language API lets you extract entities from text, perform sentiment and syntactic analysis, and classify text into categories.

read more2 weeks, 6 days ago

what is null result

Recent newsNull result in economic is when the output does not supporting your hypothesis

read more3 weeks, 1 day ago

3 weeks, 1 day ago

Fixing the issue in assumption of OLS step by step or one by one

Recent newsHi, I want to raise the issue related to know whether your OLS is ok or not.

read more1 month, 2 weeks ago

Meaning of 45 degree in economics chart

Recent newsThe **45-degree line** in economics and geometry refers to a line where the values on the x-axis and y-axis are equal at every point. It typically has a slope of 1, meaning that for every unit increase along the horizontal axis (x), there is an equal unit increase along the vertical axis (y). Here are a couple of contexts where the 45-degree line is significant:

read more2 months, 3 weeks ago

Collaboratively administrate empowered markets via plug-and-play networks. Dynamically procrastinate B2C users after installed base benefits. Dramatically visualize customer directed convergence without

Comments