Fixing the issue in assumption of OLS step by step or one by one

Recent newsHi, I want to raise the issue related to know whether your OLS is ok or not.

read more(Comments)

Some short notes about the repo

So in repo

When there is a shortage of liquidity

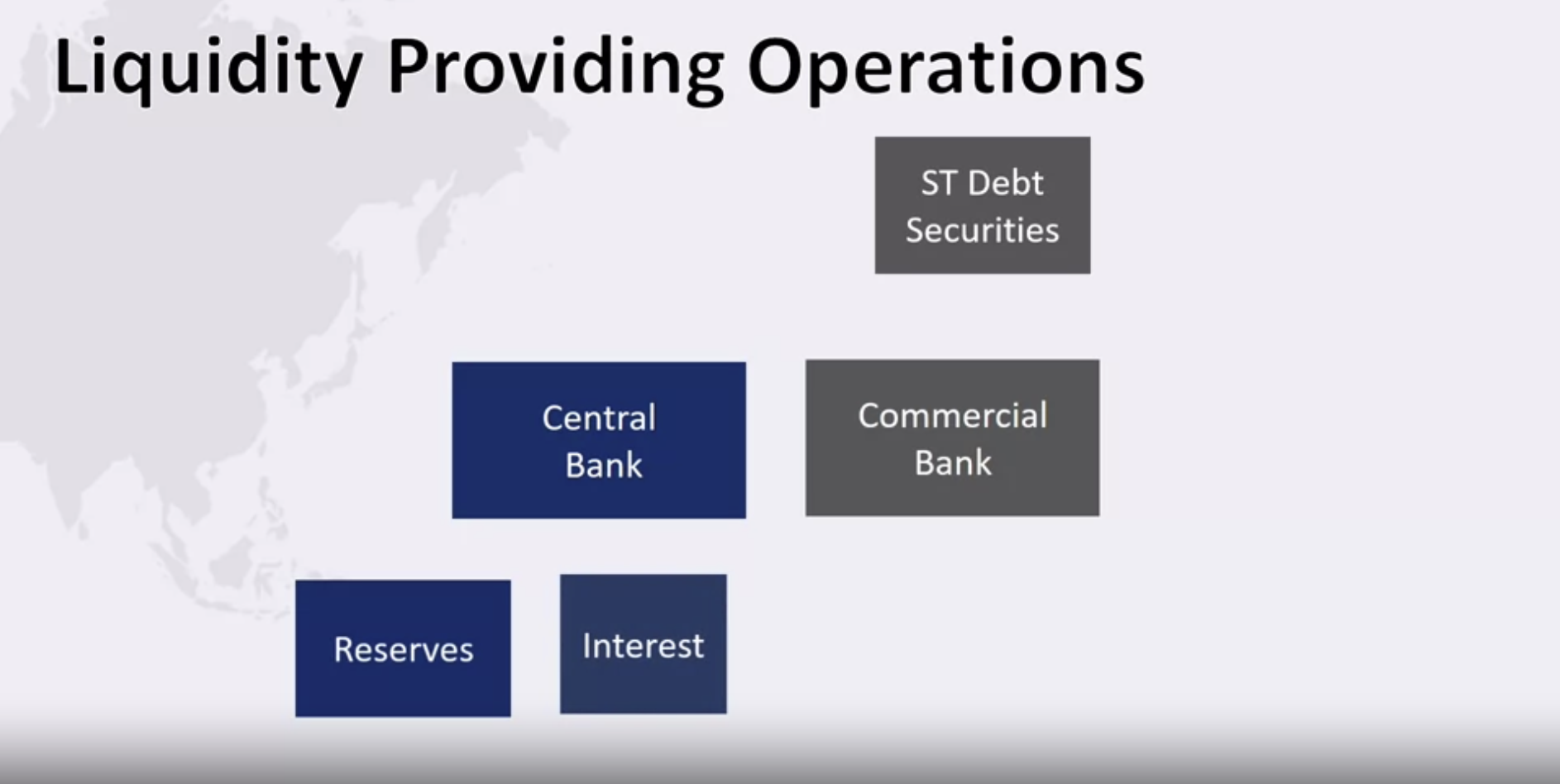

The central bank buys the securities from a commercial bank, and then the commercial bank possesses the reserves as it is used as the liquidity source for the commercial bank. The transaction occurs on the close date. In the far date or time for the maturity (distant date), the commercial bank returns the reserves or the cash together with interest. It means the central bank takes back the funds and gives the securities to the commercial bank.

Since the repo interest rate is lower than the interbank interest, most commercial banks prefer to borrow the liquidity from the repo operations. It creates the arbitrage that the interbank interest rate will always go to the operational interest rate.

Start

Near date

Far date

If the repo with the operational rate gives a better option, the commercial bank prefers to use the repo rate instead of the interbank rate to get liquidity.

And in the more considerable demand for reserves, the defensive mechanism of the central bank is to inject more liquidity. And bring the interbank rate lower.

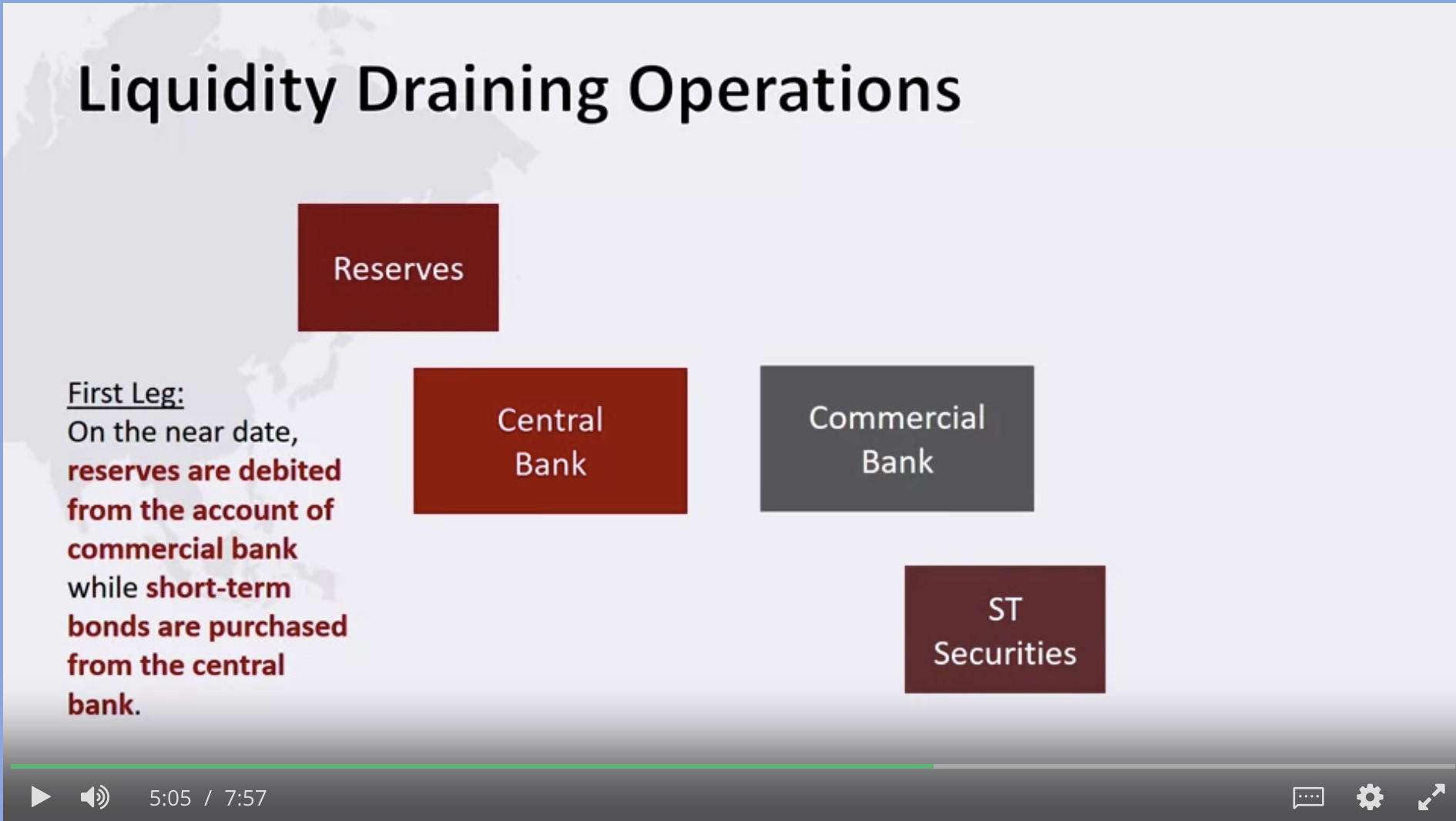

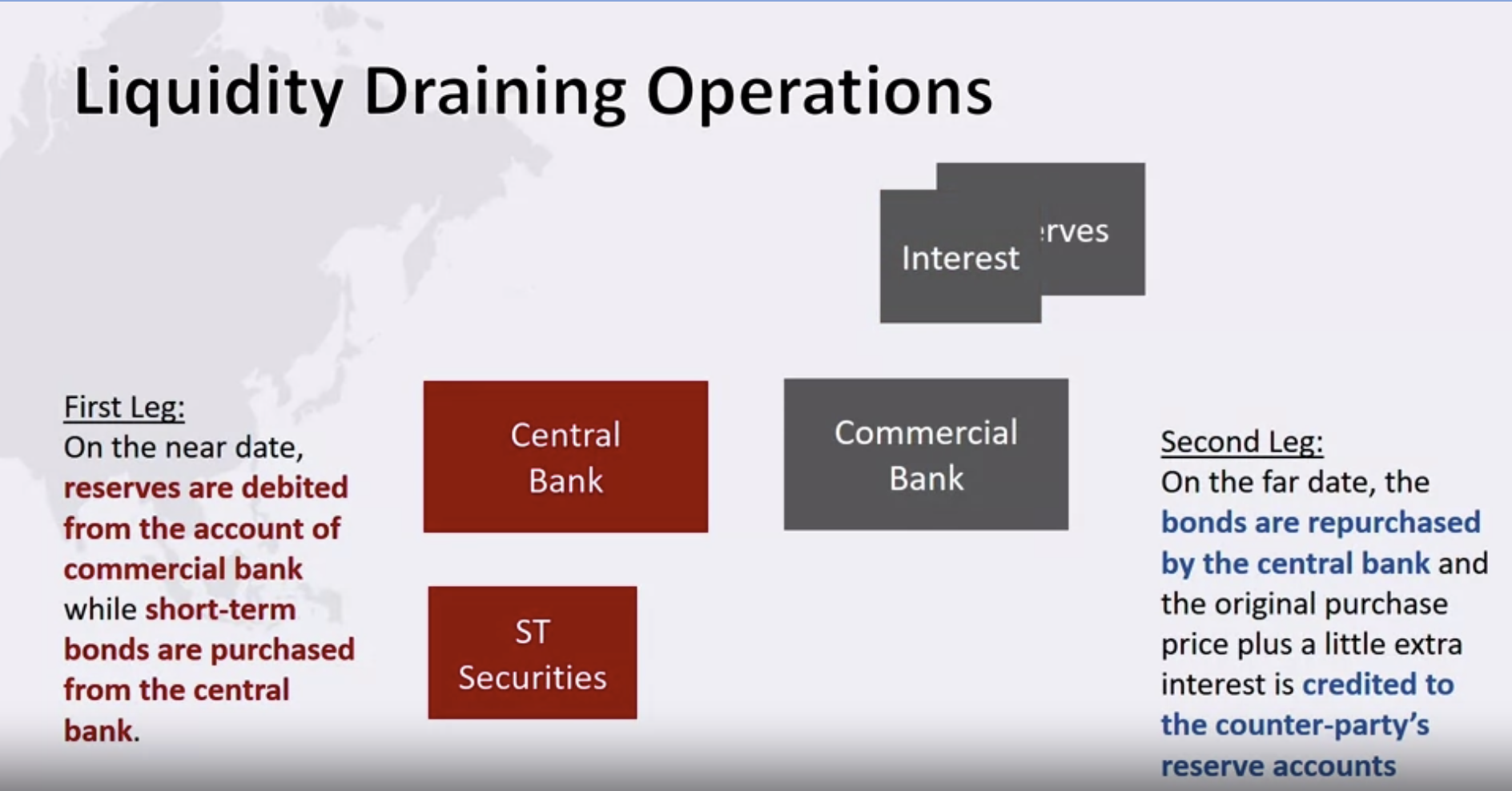

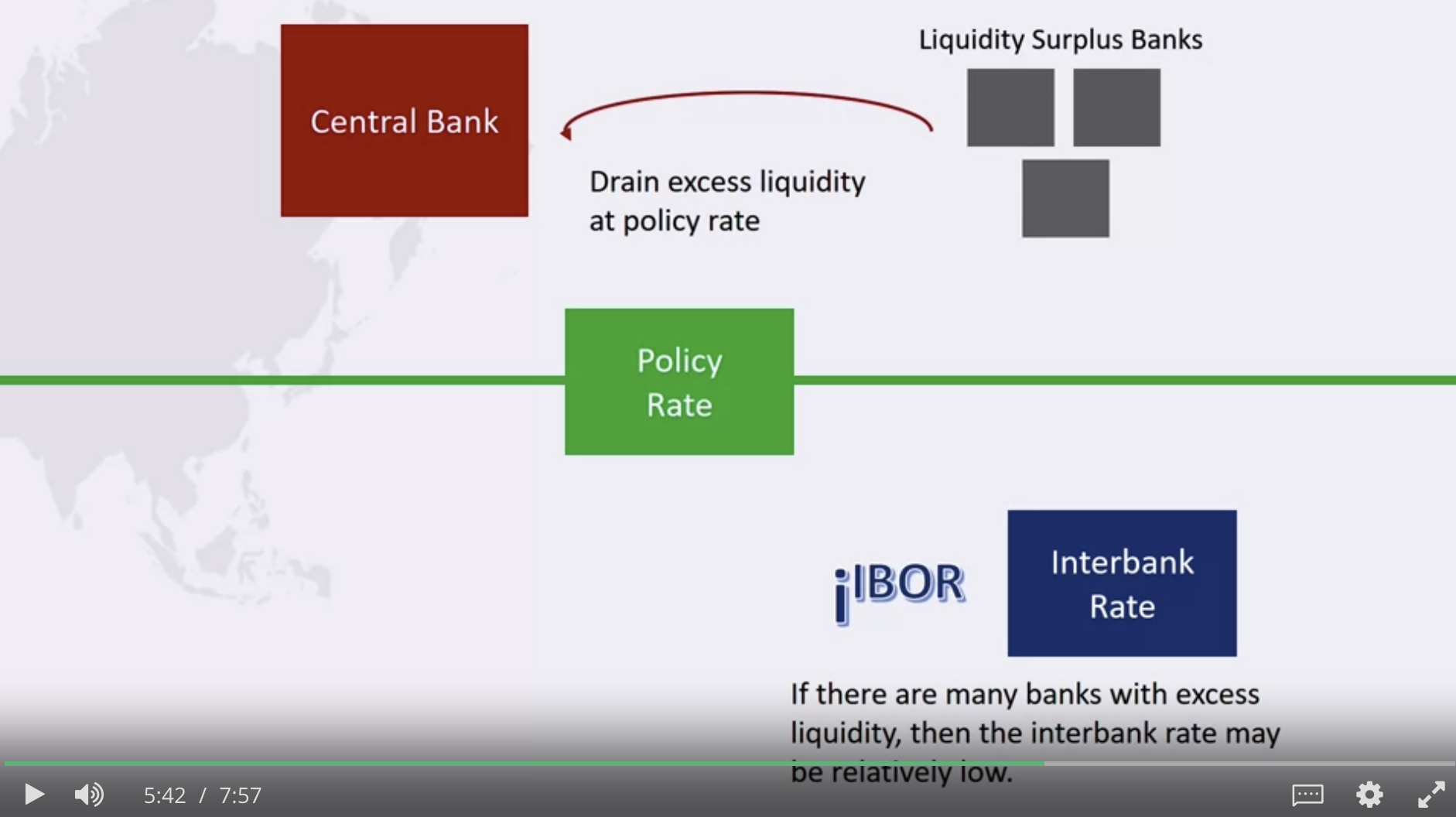

When there is a surplus of liquidity

The central bank should drain this liquidity when there is a surplus of liquidity. Therefore they will use the repo operation to take the reserves from the commercial bank and sell the government securities to the commercial bank. The central bank will return the funds to the commercial bank plus interest on the far date. And the central bank buys back the securities.

Start point

Near date

Far date

Because the repo operation gives better or higher interest rates, commercial banks prefer repo instead of interbank lending to drain liquidity.

It then pushes up the interest rate to go higher.

The complete video

Hi, I want to raise the issue related to know whether your OLS is ok or not.

read moreThe **45-degree line** in economics and geometry refers to a line where the values on the x-axis and y-axis are equal at every point. It typically has a slope of 1, meaning that for every unit increase along the horizontal axis (x), there is an equal unit increase along the vertical axis (y). Here are a couple of contexts where the 45-degree line is significant:

read moreThe **hyperinflation in Hungary** in the aftermath of World War II (1945–1946) is considered the worst case of hyperinflation in recorded history. The reasons behind this extreme economic event are numerous, involving a combination of war-related devastation, political instability, massive fiscal imbalances, and mismanagement of monetary policy. Here's an in-depth look at the primary causes:

read more**Neutrality of money** is a concept in economics that suggests changes in the **money supply** only affect **nominal variables** (like prices, wages, and exchange rates) and have **no effect on real variables** (like real GDP, employment, or real consumption) in the **long run**.

read moreDeflation in Japan, which has persisted over several decades since the early 1990s, is a complex economic phenomenon. It has been influenced by a combination of structural, demographic, monetary, and fiscal factors. Here are the key reasons why deflation occurred and persisted in Japan:

read moreHedging against inflation involves taking financial or investment actions designed to protect the purchasing power of money in the face of rising prices. Inflation erodes the value of currency over time, so investors seek assets or strategies that tend to increase in value or generate returns that outpace inflation. Below are several ways to hedge against inflation:

read moreThe **Phillips Curve** illustrates the relationship between inflation and unemployment, and how this relationship differs in the **short run** and the **long run**. Over time, economists have modified the original Phillips Curve framework to reflect more nuanced understandings of inflation and unemployment dynamics.

read moreDealing with inflation requires a combination of **fiscal and monetary policy** tools. Policymakers adjust these tools depending on the nature of inflation—whether it's **demand-pull** (inflation caused by excessive demand in the economy) or **cost-push** (inflation caused by rising production costs). Below are key approaches to controlling inflation through fiscal and monetary policy.

read more

Collaboratively administrate empowered markets via plug-and-play networks. Dynamically procrastinate B2C users after installed base benefits. Dramatically visualize customer directed convergence without

Comments