Long and short run philip curve

Posted by: admin 2 months, 4 weeks ago

(Comments)

The **Phillips Curve** illustrates the relationship between inflation and unemployment, and how this relationship differs in the **short run** and the **long run**. Over time, economists have modified the original Phillips Curve framework to reflect more nuanced understandings of inflation and unemployment dynamics.

### 1. **Phillips Curve in the Short Run**

In the short run, the **Phillips Curve** suggests an **inverse relationship** between inflation and unemployment: when unemployment is low, inflation tends to be higher, and when unemployment is high, inflation tends to be lower. This trade-off occurs because:

- **Low unemployment**: When the labor market is tight (low unemployment), workers have more bargaining power to demand higher wages. As wages rise, production costs increase for firms, and they pass these costs on to consumers by raising prices, leading to higher inflation.

- **High unemployment**: When unemployment is high, workers have less bargaining power, wage growth slows, and inflation tends to be lower.

#### **Short-Run Phillips Curve (SRPC)**

- The **SRPC** shows that policymakers can temporarily lower unemployment by accepting higher inflation (e.g., through expansionary fiscal or monetary policy), or they can reduce inflation at the cost of higher unemployment (through contractionary policies).

- In this context, the trade-off implies that **stimulating the economy** (via increased demand) will reduce unemployment but increase inflation. Conversely, reducing inflation may cause higher unemployment.

However, this trade-off only holds in the **short run**, primarily because of the role of **inflation expectations**.

### 2. **Phillips Curve in the Long Run**

In the long run, the relationship between inflation and unemployment changes due to the role of expectations. **Milton Friedman** and **Edmund Phelps** introduced the concept of the **Natural Rate of Unemployment** (NRU) and **Expectations-Augmented Phillips Curve**, which show that in the long run, there is **no trade-off** between inflation and unemployment.

#### **Natural Rate of Unemployment (NRU) or Non-Accelerating Inflation Rate of Unemployment (NAIRU)**

- In the long run, the economy tends to return to its **natural rate of unemployment** (also called **NAIRU**). This is the level of unemployment where the labor market is in equilibrium, and inflation is stable. The NRU reflects factors such as labor market frictions, structural unemployment, and the efficiency of job matching.

- According to the long-run Phillips Curve (LRPC), unemployment gravitates toward the **natural rate**, regardless of the inflation rate. Thus, in the long run, unemployment is determined by real factors (e.g., labor market efficiency), not inflation.

#### **Long-Run Phillips Curve (LRPC)**

- The **LRPC** is **vertical** at the natural rate of unemployment, indicating that there is **no long-term trade-off** between inflation and unemployment. In other words, you cannot permanently lower unemployment by accepting higher inflation, and inflationary policies won't reduce unemployment over time.

- If policymakers attempt to keep unemployment below the natural rate by stimulating the economy (e.g., via expansionary monetary policy), it will lead to rising inflation without any sustained reduction in unemployment.

### 3. **Expectations-Augmented Phillips Curve**

In the **expectations-augmented Phillips Curve**, inflation expectations play a critical role in determining the shape and dynamics of the Phillips Curve. The idea is that if workers and firms expect higher inflation in the future, they will adjust their behavior (demand higher wages or increase prices) accordingly. This modification leads to different outcomes in the short and long run.

#### Short Run with Expectations

- In the **short run**, if inflation expectations are **low or stable**, there may still be a trade-off between unemployment and inflation. Policymakers can lower unemployment by accepting higher inflation for a while.

- However, if policymakers try to keep unemployment below the natural rate for too long, inflation expectations will adjust. Workers will demand higher wages because they expect prices to rise, and firms will raise prices because they expect higher wage costs. This leads to a situation where inflation rises but unemployment returns to its natural rate.

#### Long Run with Expectations

- In the **long run**, inflation expectations adjust fully to actual inflation. This means that attempts to reduce unemployment below the natural rate will only lead to **accelerating inflation** without any permanent gains in reducing unemployment.

- As inflation expectations increase, the short-run Phillips Curve shifts **upward**, meaning that at any given unemployment rate, inflation will be higher. This results in a **vertical long-run Phillips Curve**, where unemployment cannot be permanently reduced by higher inflation.

### 4. **Shifts in the Phillips Curve**

- **Short-Run Shifts**: The short-run Phillips Curve can shift due to changes in inflation expectations or supply shocks.

- **Supply shocks** (such as rising oil prices or a natural disaster) can cause the SRPC to shift **upward**, meaning higher inflation at every level of unemployment. This is also referred to as **cost-push inflation**.

- **Demand shocks** (such as fiscal or monetary stimulus) may move the economy along the Phillips Curve, temporarily reducing unemployment but increasing inflation.

- **Changes in inflation expectations**: If people expect higher future inflation, the short-run Phillips Curve shifts upward because firms and workers adjust their behavior (raising prices or wages) based on these expectations.

- **Long-Run Shifts**: The long-run Phillips Curve is generally stable at the **natural rate of unemployment**, but it can shift due to structural changes in the economy.

- **Improvements in labor market efficiency**, such as better job matching or retraining programs, can lower the natural rate of unemployment, shifting the LRPC to the left.

- **Demographic changes** or changes in labor force participation can also shift the natural rate of unemployment, altering the position of the long-run Phillips Curve.

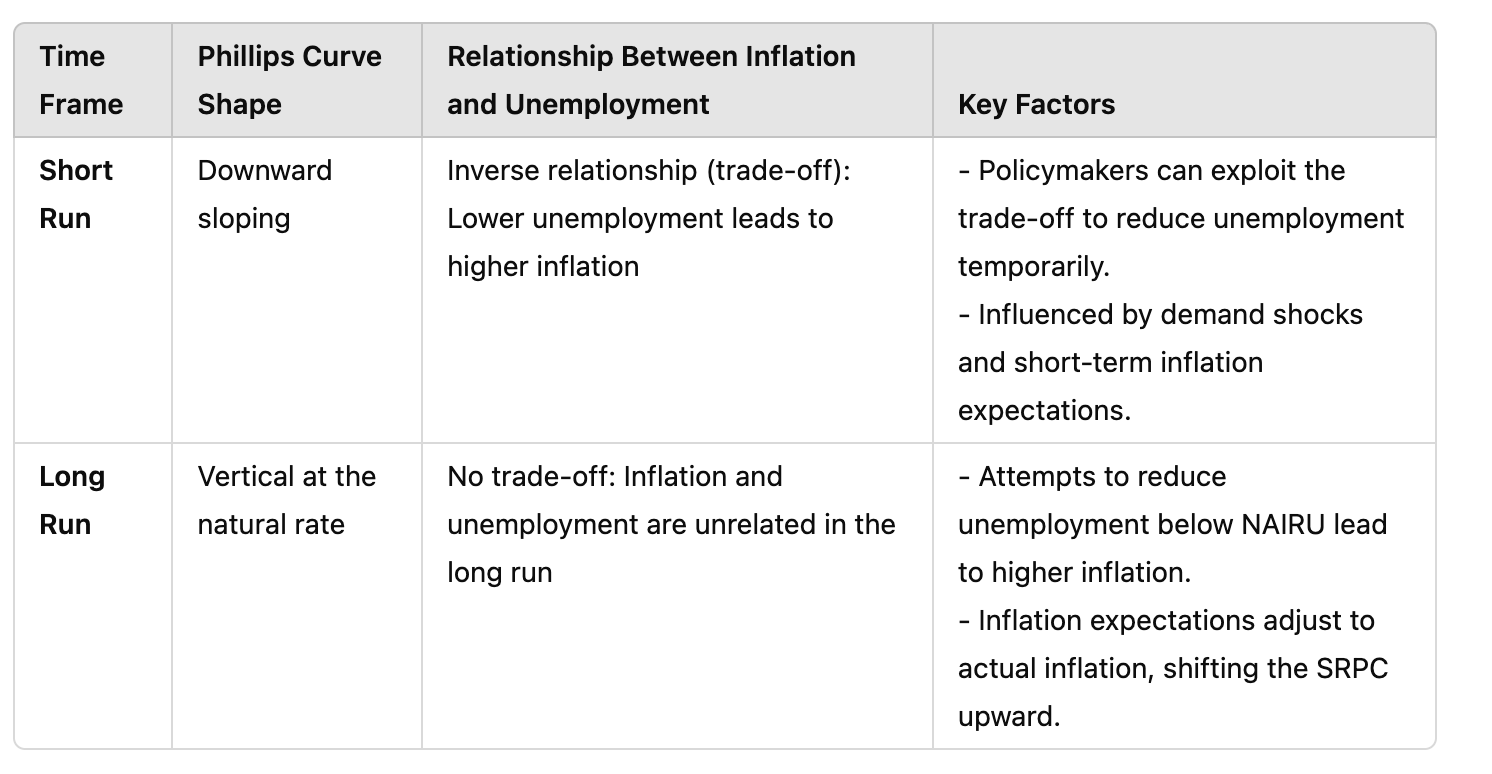

### Summary of the Phillips Curve in the Short Run and Long Run

### Policy Implications

- **Short-Run Policy**: In the short run, policymakers may use fiscal or monetary stimulus to reduce unemployment, but they must be cautious of rising inflation. If inflation expectations are low and stable, there may be some room for reducing unemployment at the cost of slightly higher inflation.

- **Long-Run Policy**: In the long run, efforts to lower unemployment below the natural rate will only lead to higher inflation. Policymakers must focus on maintaining stable inflation expectations and addressing structural issues in the labor market to reduce the natural rate of unemployment. Expansionary policies that persistently aim to lower unemployment below the natural rate will result in higher inflation without long-term gains in employment.

Thus, the **short-run Phillips Curve** presents a potential trade-off between inflation and unemployment, but this trade-off disappears in the **long run**, where inflation expectations adjust, leaving no long-term link between inflation and unemployment.

Kenapa sekolah PhD butuh waktu lama!?

Recent newsKali ini kita akan bahas kenapa sekolah PhD itu lama! Tanpa panjang lebar, berikut cara ngeles gw! Maksudnya berikut alasannya! Hope its relate with you!

read more1 day, 2 hours ago

Using Vertex AI for zero one and two three AI prediction

Recent newsHere is my documentation after learning the introduction of AI in courserERA.

read more2 weeks, 4 days ago

Neural network with API for pre-trained API

Recent newsOverview

The Cloud Natural Language API lets you extract entities from text, perform sentiment and syntactic analysis, and classify text into categories.

read more2 weeks, 6 days ago

what is null result

Recent newsNull result in economic is when the output does not supporting your hypothesis

read more3 weeks, 1 day ago

3 weeks, 1 day ago

Fixing the issue in assumption of OLS step by step or one by one

Recent newsHi, I want to raise the issue related to know whether your OLS is ok or not.

read more1 month, 2 weeks ago

Meaning of 45 degree in economics chart

Recent newsThe **45-degree line** in economics and geometry refers to a line where the values on the x-axis and y-axis are equal at every point. It typically has a slope of 1, meaning that for every unit increase along the horizontal axis (x), there is an equal unit increase along the vertical axis (y). Here are a couple of contexts where the 45-degree line is significant:

read more2 months, 3 weeks ago

Collaboratively administrate empowered markets via plug-and-play networks. Dynamically procrastinate B2C users after installed base benefits. Dramatically visualize customer directed convergence without

Comments