Fixing the issue in assumption of OLS step by step or one by one

Recent newsHi, I want to raise the issue related to know whether your OLS is ok or not.

read more(Comments)

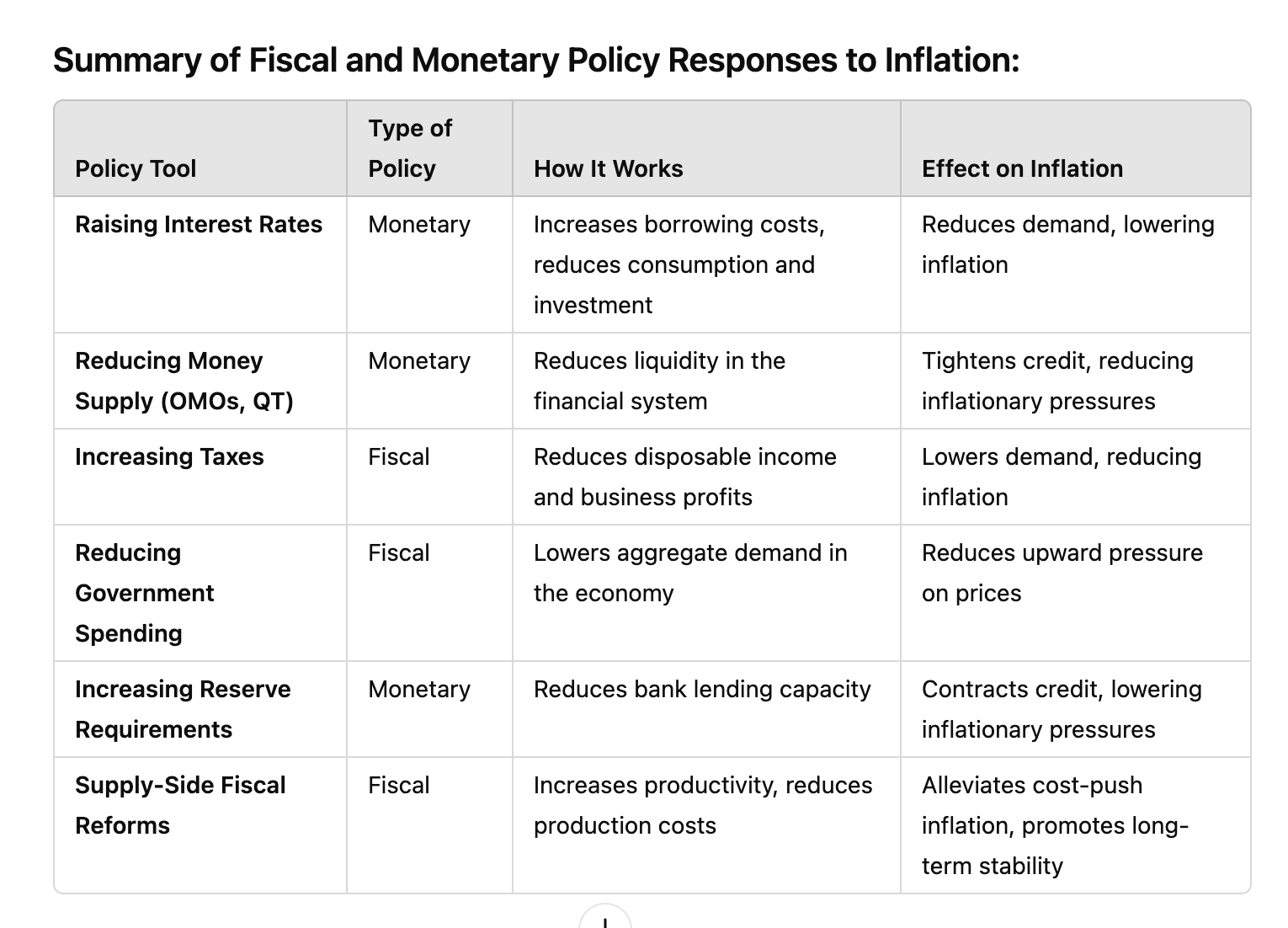

Dealing with inflation requires a combination of **fiscal and monetary policy** tools. Policymakers adjust these tools depending on the nature of inflation—whether it's **demand-pull** (inflation caused by excessive demand in the economy) or **cost-push** (inflation caused by rising production costs). Below are key approaches to controlling inflation through fiscal and monetary policy.

### 1. **Monetary Policy Tools for Controlling Inflation**

Monetary policy is often the **primary tool** for controlling inflation. Central banks (such as the Federal Reserve, the European Central Bank, or the Bank of England) have several instruments to reduce inflation by managing the money supply and influencing interest rates.

#### **Key Monetary Policy Tools:**

##### a) **Raising Interest Rates**

- **How it Works**: Central banks raise the **policy interest rate** (e.g., the federal funds rate in the U.S.), making borrowing more expensive for businesses and consumers.

- **Effect**: Higher interest rates reduce **investment** and **consumer spending** (particularly on interest-sensitive purchases like homes and cars), which lowers aggregate demand in the economy. This helps cool down inflationary pressures by reducing the amount of money circulating in the economy.

- **Example**: The U.S. Federal Reserve raising interest rates in response to rising inflation in the 1980s and more recently in 2022-2023 to combat inflation caused by supply chain disruptions and high demand.

##### b) **Open Market Operations (OMOs)**

- **How it Works**: Central banks sell government securities (bonds) to financial institutions. This reduces the money supply because financial institutions pay for these bonds with their reserves, which tightens liquidity.

- **Effect**: As liquidity tightens, the money supply contracts, pushing interest rates higher. This dampens inflation by reducing the availability of credit and, thus, slowing down spending and investment.

##### c) **Increasing Reserve Requirements**

- **How it Works**: Central banks can increase the **reserve requirement**, which is the percentage of deposits that commercial banks must hold in reserve (and cannot lend out).

- **Effect**: When reserve requirements increase, banks have less money to lend, which reduces the money supply and slows down the growth of credit in the economy. This decrease in lending activity curbs demand and helps lower inflationary pressures.

##### d) **Quantitative Tightening (QT)**

- **How it Works**: Quantitative tightening is the opposite of **quantitative easing (QE)**. Instead of purchasing government and corporate bonds (which injects liquidity), the central bank sells off assets it holds, reducing liquidity in the financial system.

- **Effect**: This reduction in liquidity raises long-term interest rates, reducing borrowing and investment, and thus dampens inflation.

#### **Monetary Policy Considerations**:

- **Inflation Targeting**: Central banks often set a specific inflation target (e.g., 2%) and adjust interest rates accordingly to keep inflation within this range.

- **Managing Inflation Expectations**: Central banks also work to **anchor inflation expectations** by clearly communicating their goals. If people expect inflation to remain low, they are less likely to demand higher wages or raise prices preemptively, which helps keep inflation under control.

### 2. **Fiscal Policy Tools for Controlling Inflation**

Fiscal policy involves the government adjusting its spending levels and taxation to influence the economy. While monetary policy is typically more effective in controlling inflation, fiscal policy can also play an important role.

#### **Key Fiscal Policy Tools:**

##### a) **Reducing Government Spending**

- **How it Works**: The government can reduce its spending on goods and services, infrastructure, defense, and public programs.

- **Effect**: Lower government spending reduces aggregate demand in the economy. When demand falls, there is less upward pressure on prices, which helps reduce inflation.

- **Example**: Austerity measures or reduced public investment during periods of high inflation to cool down the economy.

##### b) **Increasing Taxes**

- **How it Works**: The government can increase personal or corporate income taxes, consumption taxes (like sales or VAT), or property taxes.

- **Effect**: Higher taxes reduce consumers’ disposable income and businesses' profits, lowering consumption and investment. This reduces aggregate demand and helps control inflation.

- **Example**: Increases in income or corporate taxes can lower household and business spending, contributing to a reduction in inflationary pressures.

##### c) **Reducing Fiscal Deficits**

- **How it Works**: By reducing budget deficits (or turning them into surpluses), the government reduces the amount of money it needs to borrow.

- **Effect**: Lower deficits reduce the pressure on the money supply and interest rates, which can prevent inflation from rising. In periods of excessive inflation, reducing the fiscal deficit can act as a signal of fiscal discipline, which helps manage inflation expectations.

- **Example**: Implementing budget cuts or reducing public sector wages to control inflation.

#### **Fiscal Policy Considerations**:

- **Supply-Side Reforms**: In some cases, governments may adopt **supply-side policies** (e.g., reducing regulation or investing in infrastructure) to improve productivity and reduce costs in the long run, which can also help combat cost-push inflation.

- **Balanced Approach**: Governments must balance the inflation-fighting benefits of reducing spending and raising taxes with the potential negative impacts on economic growth and employment.

### 3. **Combining Fiscal and Monetary Policy to Combat Inflation**

In many cases, addressing inflation effectively requires **coordinated actions between monetary and fiscal policy**. Here are key ways the two can work together:

- **Monetary Tightening + Fiscal Contraction**: A combination of raising interest rates and cutting government spending can be a powerful tool to fight inflation. This reduces both the money supply and aggregate demand, tackling inflation from both monetary and fiscal angles.

- **Monetary Tightening + Supply-Side Fiscal Policy**: Central banks may raise interest rates, while the government implements long-term structural reforms to increase productivity and reduce supply constraints. This combination can help address inflation without severely cutting demand.

- **Fiscal Restraint to Support Monetary Policy**: When central banks are raising interest rates, governments can avoid increasing deficits or implementing large fiscal stimulus measures that could counteract the monetary tightening.

### 4. **Dealing with Different Types of Inflation**

- **Demand-Pull Inflation**: If inflation is driven by excessive demand (e.g., due to fiscal stimulus, low interest rates, or consumer confidence), monetary tightening and reducing fiscal stimulus are effective strategies. Raising interest rates and cutting government spending directly reduce demand in the economy.

- **Cost-Push Inflation**: If inflation is caused by rising production costs (e.g., due to higher wages or commodity prices), the central bank faces a trade-off. Tightening monetary policy may help control inflation, but it could also reduce output further. In this case, supply-side fiscal policies (like improving productivity or reducing taxes on inputs) can complement monetary policy by addressing the root cause of the cost increases.

### Conclusion

- **Monetary policy** (through interest rate hikes and controlling the money supply) is the most direct and effective tool for managing inflation.

- **Fiscal policy** can also help by reducing aggregate demand (through higher taxes or lower government spending) or addressing supply constraints.

- A coordinated approach between fiscal and monetary policy is often necessary to balance inflation control with supporting growth and employment.

Hi, I want to raise the issue related to know whether your OLS is ok or not.

read moreThe **45-degree line** in economics and geometry refers to a line where the values on the x-axis and y-axis are equal at every point. It typically has a slope of 1, meaning that for every unit increase along the horizontal axis (x), there is an equal unit increase along the vertical axis (y). Here are a couple of contexts where the 45-degree line is significant:

read moreThe **hyperinflation in Hungary** in the aftermath of World War II (1945–1946) is considered the worst case of hyperinflation in recorded history. The reasons behind this extreme economic event are numerous, involving a combination of war-related devastation, political instability, massive fiscal imbalances, and mismanagement of monetary policy. Here's an in-depth look at the primary causes:

read more**Neutrality of money** is a concept in economics that suggests changes in the **money supply** only affect **nominal variables** (like prices, wages, and exchange rates) and have **no effect on real variables** (like real GDP, employment, or real consumption) in the **long run**.

read moreDeflation in Japan, which has persisted over several decades since the early 1990s, is a complex economic phenomenon. It has been influenced by a combination of structural, demographic, monetary, and fiscal factors. Here are the key reasons why deflation occurred and persisted in Japan:

read moreHedging against inflation involves taking financial or investment actions designed to protect the purchasing power of money in the face of rising prices. Inflation erodes the value of currency over time, so investors seek assets or strategies that tend to increase in value or generate returns that outpace inflation. Below are several ways to hedge against inflation:

read moreThe **Phillips Curve** illustrates the relationship between inflation and unemployment, and how this relationship differs in the **short run** and the **long run**. Over time, economists have modified the original Phillips Curve framework to reflect more nuanced understandings of inflation and unemployment dynamics.

read moreDealing with inflation requires a combination of **fiscal and monetary policy** tools. Policymakers adjust these tools depending on the nature of inflation—whether it's **demand-pull** (inflation caused by excessive demand in the economy) or **cost-push** (inflation caused by rising production costs). Below are key approaches to controlling inflation through fiscal and monetary policy.

read more

Collaboratively administrate empowered markets via plug-and-play networks. Dynamically procrastinate B2C users after installed base benefits. Dramatically visualize customer directed convergence without

Comments